April 15 is the deadline for submitting taxes for most Americans. But not for Wrangell residents and businesses – at least not this year.

The Internal Revenue Service announced last week that Wrangell taxpayers have until July 15.

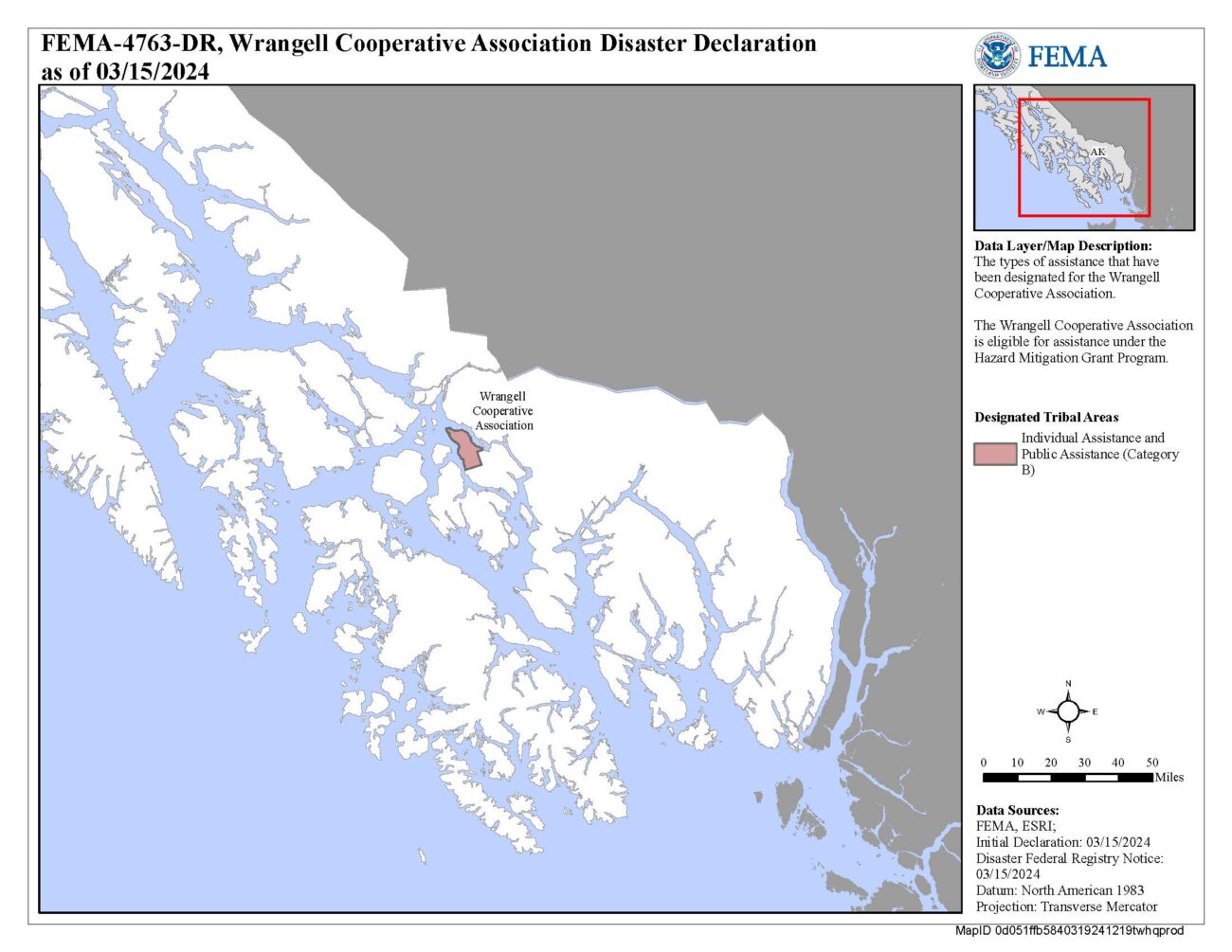

This follows the Federal Emergency Management Agency’s disaster declaration to Wrangell’s federally recognized tribe, for last November’s fatal landslide.

Collin Dando is a certified public accountant in Wrangell. For full disclosure, Collin Dando is a Coast Alaska board member, which is the governing board for KSTK. He said that the IRS designated all of Wrangell as a natural disaster area.

“I have confirmed with the IRS that it doesn’t matter if you are actually impacted by the landslide,” he said. “They’ve just done a blanket extension for the entire zip code.”

So for anyone who resides or does business in the 99929 zip code, the IRS automatically filed the July 15 deadline into their account. Taxpayers do not need to file an extension unless they need more time after July 15. If they need an extension, Dando recommends that Wrangellites file for it before April 15.

“Otherwise, you have to file a paper extension and then those take a long time to process and can get lost,” he said.

Similar to the COVID extension deadline

Other tax payments qualify for the July 15 deadline as well, such as quarterly estimated tax payments and other returns and payments that refer to businesses, organizations and corporations.

Basically, any deadline between November 20 and July 15 has a July 15, 2024 deadline.

“Kind of like when COVID happened and they extended the deadline of everyone in the country,” Dando said. “It’s essentially the same thing. It’s just specific to Wrangell due to the landslides.”

Dando said that if anyone has questions or wants to make sure they qualify for the automatic tax deadline, it’s important to reach out to an accountant for individual advice.

He said if a Wrangell taxpayer receives a late filing or payment penalty notice from the IRS, they should call the phone number on the notice to have the IRS clear the penalty.

Also, Wrangell taxpayers should request the IRS to include them in the tax relief if they reside or does business outside of town, or who hasn’t changed their address to the 99929 zip code. This can be done by calling the IRS disaster hotline at 866-562-5227.